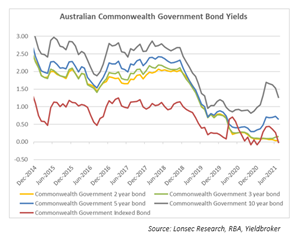

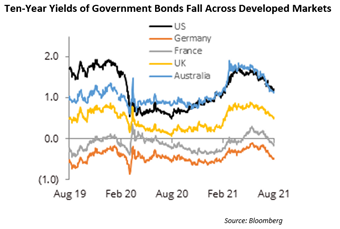

According to a report in Bloomberg recently, while Vanguard data show a portfolio with 60 equities/fixed income mix returned an average 9.1% a year from 1926 to 2020, JP Morgan Asset Management recently estimated it will return just 3.7% over the next decade. Why? In a world where 85% of developed-market government bonds are yielding below 1%, the likely returns from the fixed income component of the portfolio has plunged, as shown in Figures 1 and 2.

Figure 1

Figure 2

So, this raises a question that we are getting asked by our clients – why even bother having fixed income within my portfolio?

When answering this question, it is important to think about what the reasons were for including fixed income in your portfolio in the first place.

At Lonsec, we believe that fixed income generally can play three roles in a portfolio:

-

As a diversifier to equities – bonds dampen overall portfolio volatility when held in a portfolio with riskier assets such as equities;

-

As a defensive asset that “will not go down” – so may be suitable for the risk averse investor with a primary objective being the preservation of capital; and

-

As a provider of a steady income stream – regular income payments from bonds provide a stable income stream for retirees

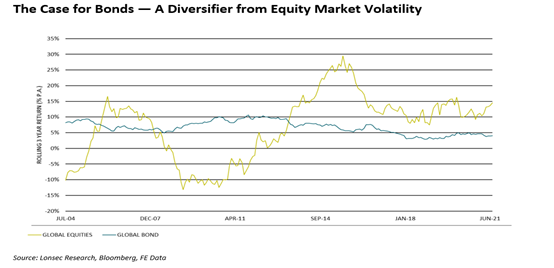

Figure 3 shows the rolling three year returns for global equities and global bonds and serves to highlight the relatively low volatility of global bonds compared to global equities.

Figure 3

However, when faced with the prospect of challenging returns, the reasons for inclusion tend to fall by the wayside and we start to focus on where to find better returns. As a result, we have seen many investors move out of fixed interest securities, especially longer term government bonds, in favour of equities or a taking a bar bell approach by investing in the extremes of lower quality investment grade bonds and short duration cash like securities. This is a dangerous proposition especially for those in retirement.

Becoming a victim of short-termism and negative momentum can shift your portfolio greatly to one that effectively eradicates each of those objectives we listed above. Why?

-

When we increase our allocation to equities or riskier assets, we are reducing our diversification. This will significantly increase the volatility of the portfolio.

-

Whilst the short duration assets will act has a buffer during times of market volatility, we have seen time and time again, that lower quality investment bonds will typically have their correlation to equities rise to 1 during periods of market stress and produce a very significant negative return that effectively wipes out any ‘buffering’ that the short duration assets may have provided.

-

During periods of economic stress, the stability of income from equities can change quickly. We saw this last year when many banks cut their dividends for a short period of time to ensure their books were able to withstand the changing economic landscape.

-

For retirees, unless the income provided through dividends and higher yielding fixed income securities is sufficient enough to live on, the impact of falling markets when in drawdown can be catastrophic to the long term viability of a retirement portfolio.

The question around the validity of longer duration bonds in portfolios is a valid one. Fund managers have been able to lean on these as performance enhancers as dovish central banks have overseen 20 years of falling interest rates. This, coupled with the relentless demand for safe haven assets from investors, especially during times of equity market stress, has seen abnormally high returns being achieved in this end of the market.

A fact that we all quickly forget about volatility is that with riskier assets not only do you have a greater probability of producing higher returns, you also have a greater probability of producing lower returns.

Whilst historically it has been easy to forget about fixed interest as the asset class has taken a backseat to the action packed excitement of the sharemarket, we cannot do this anymore, especially if you are approaching or in retirement. This is the stage where preservation of capital with a guaranteed income stream becomes the most important goal.

For those especially, bond investors now have three choices:

-

Take on more risk to generate higher yields;

-

Lower return expectations for the short to medium term; or

-

Accept low rates as something they cannot change.

If you have any questions regarding your investment mix, call us today on Phone 02 9548 3703.

Source: Lonsec

Reproduced with the permission of Lonsesc. This article by was originally published at https://www.lonsec.com.au/2021/09/09/with-rates-close-to-0-why-bother-with-fixed-income/

Important:

This provides general information and hasn’t taken your circumstances into account. It’s important to consider your particular circumstances before deciding what’s right for you. Although the information is from sources considered reliable, we do not guarantee that it is accurate or complete. You should not rely upon it and should seek qualified advice before making any investment decision. Except where liability under any statute cannot be excluded, we do not accept any liability (whether under contract, tort or otherwise) for any resulting loss or damage of the reader or any other person.

Any information provided by the author detailed above is separate and external to our business and our Licensee. Neither our business nor our Licensee takes any responsibility for any action or any service provided by the author. Any links have been provided with permission for information purposes only and will take you to external websites, which are not connected to our company in any way. Note: Our company does not endorse and is not responsible for the accuracy of the contents/information contained within the linked site(s) accessible from this page.