We’re here to help you understand what happens in a share market downturn,

If you’ve seen a decrease to your super balance as a result of the coronavirus, it’s understandably cause for concern.

When your balance goes down (or up), it’s as a result of changes in the value of investments in your super fund — this could be a mix of cash, shares, fixed income, property, and more—and, of course, your balance will change when you or your employer adds money each month, or when you withdraw money in retirement or through insurance premiums, fees and taxes.

Severe as they can feel, events like this aren’t permanent. In fact, based on history, markets have bounced back from other global shocks including epidemics like SARS and Swine Flu.

In this article, we’ll address five key areas to consider when it comes to thinking about your super in a market downturn and when there’s increased volatility.

1. Maintain a long-term perspective

Super is like any type of investment, there will be times of highs and lows. For the majority of Australians, super may be our longest-term investment given we start investing in super when we get our first job and don’t access the money until retirement.

It’s also the nature of investment markets to change rapidly, particularly shares, property or fixed income investments. The share market for example, is a public market so when the share market rises or falls, changes in share prices may impact the value of your super if it’s invested in shares.

Markets recover with time

But from what we’ve seen in the past with events that disrupt investment markets, markets do eventually recover, it just takes time.

From the 1987 Stock Market Crash to the bursting of the Tech Bubble in 2000, each trigger is different and the time it takes to recover varies too — it can take months, weeks or even years. While disruptions to markets occur fairly regularly, they are impossible to accurately predict.

So, if you do decide to make changes to your investments during falling markets—like switching to a different type of portfolio—it’s important to also consider what impact that will have on your returns when markets recover.

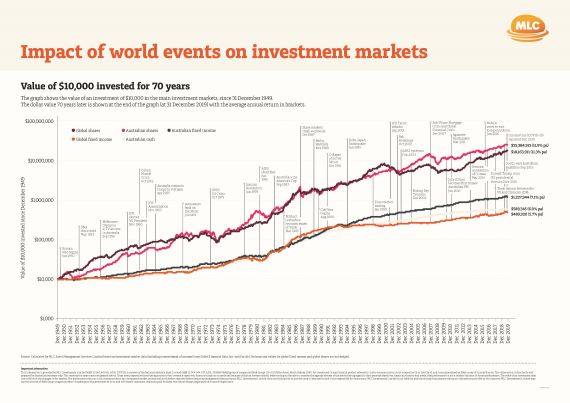

The value of $10,000 invested for 70 years

The dollar value 70 years later is shown at the end of the graph (at 31 December 2019) with the average annual return in brackets.

2. Review your investment strategy

While these events may make you want to take action, it’s important to take a moment to consider your investment strategy including why you invested that way in the first place.

Understanding the investments that make up your strategy and how they are expected to perform over long periods of time, can help you think about your strategy objectively, instead of reactively. Particularly short-term market volatility which can influence your investment decisions.

If your strategy is intended to be a long-term plan, which may be the case for those with a long way to go before they retire, making decisions based on short-term market fluctuations may greatly affect whether you achieve your long-term goals.

If you’re approaching or are in retirement, it’s still important to stay focused on your investment strategy. Carefully consider all of your options, and their impact on your retirement goals, before making any significant changes. Speaking to a financial adviser may help with this.

3. Be aware of your risk tolerance

It’s always important to consider how you feel about risk and market volatility.

By understanding your risk tolerance, you’ll be better able to make decisions about the structure of your investment portfolio in a way that aligns to you personally. Risk tolerance depends on how you feel about taking risk and your ability to do so, such as whether you are financially able to bear the risk.

Asset classes like shares and property, have higher return potential and experience greater fluctuations in value, than cash or fixed income investments. How much exposure you choose to have in each of these asset classes, may change depending on your level of comfort, especially during periods of investment market instability.

4. Consider diversification

One of the most effective ways of reducing the impacts of investment fluctuations is to diversify. Multi-asset or diversified funds invest across multiple asset classes to assist in reducing volatility.

Diversification essentially follows the concept of not putting all your eggs in one basket by spreading your money across many asset classes, countries, industries, companies, and even investment managers.

When one area of your portfolio is weak and falling, another may be rising strongly. If you have money invested across many areas, changes in their values tend to balance each other out.

Diversification doesn’t mean you can avoid negative returns altogether, but it helps reduce the size and frequency of fluctuations in your portfolio. Particularly compared to if you’d only invested in shares, for instance.

5. Seek support from a professional

Super funds have lots of information available online to help you understand your savings.

Working with a financial adviser can help you design a plan to achieve your financial goals. Please contact us on Phone 02 9548 3703 We may also provide you with a better understanding about the risks and rewards of investing and how you can manage risk.

While the impact of market volatility can affect your super, it’s important to remember it won’t last forever. The investment strategy you adopt should take into account factors including—your financial goals and the savings required to get there, the number of years you have to invest, the return you can expect from your investments, and how comfortable you are with volatility.

Source : MLC Insights April 2020

Important information and disclaimer

This article has been prepared by NULIS Nominees (Australia) Limited ABN 80 008 515 633 AFSL 236465 (NULIS) as trustee of the MLC Super Fund ABN 70 732 426 024. The information in this article is current as at 2 April 2020 and may be subject to change. The information in this article is general in nature and does not take into account your objectives, financial situation or needs. You should consider obtaining independent advice before making any financial decisions based on this information. You should not rely on this article to determine your personal tax obligations. Please consult a registered tax agent for this purpose. An investment with NULIS is not a deposit with, or liability of, and is not guaranteed by NAB or other members of the NAB Group. Opinions constitute our judgement at the time of issue. In some cases information has been provided to us by third parties and while that information is believed to be accurate and reliable, its accuracy is not guaranteed in any way. Subject to terms implied by law and which cannot be excluded, neither NULIS nor any member of the NAB Group accept responsibility for any loss or liability incurred by you in respect of any error, omission or misrepresentation in the information in this communication. Past performance is not a reliable indicator of future performance. The value of an investment may rise or fall with the changes in the market.